Norseman Signs Exclusive Option To Acquire The Caballos Copper Project In Chile

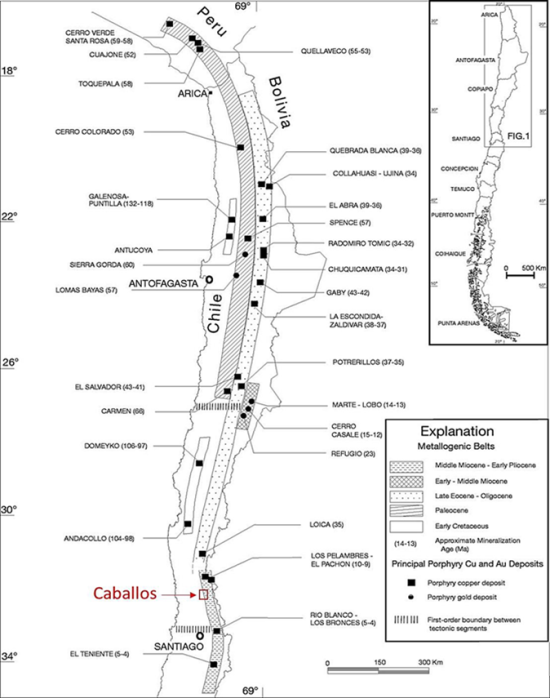

Vancouver, British Columbia November 30, 2023 – Norseman Silver Inc. (TSXV: NOC) (OTCQB: NOCSF) (“Norseman” or the “Company”) is pleased to announce it has secured an exclusive option to acquire 100% of the Caballos Copper Project, located in the Valparaiso Region of Chile, from Asesorias y Inversiones J.V&A. Ltda and Inversiones y Asesorias Doce S.A (“the Vendors”). The project comprises 18,000 Ha of concessions, at an average altitude of 2,200 m. The project is located 210 km by road to Santiago, 56 km south of Los Pelambres, 97 km north of Los Bronces, and 80 km from the coast. The option agreement was signed on November 23, 2023.

Highlights:

- Anomalous copper in several zones along a 10 km structural corridor

- Coincident soil and geophysical anomalies form a large target at “Cerro Las Mulas”

- Cerro Las Mulas is drill-ready and hosts mineralization at surface

Campbell Smyth, Norseman's Chairman, commented:

“Caballos offers a unique opportunity to explore a significant copper target that was advanced to its current drill-ready status by Vale. The project is located on the flanks of a geological belt that stretches from Antofagasta plc’s Los Pelambres mine to Anglo American’s Los Bronces copper mine. Los Pelambres and Los Bronces have endowments of 36 million and 44 million tonnes of contained copper respectively. Both operations produce over 300,000 tonnes of copper annually.

Norseman is exploring in the land of giants and there is an ongoing shortage of large copper assets with good grade, clean metallurgy and simple geometry. Caballos is a strategic land holding with abundant copper, gold and molybdenum mineralization, in the world’s premier copper jurisdiction. We plan to drill Caballos in the second half of 2024 and are currently building up our local exploration team.”

Merlin Marr-Johnson, Technical Advisor to Norseman, added:

“The geology at the Cerro Las Mulas target is indicative of being in the core of a porphyry system. Well defined soil and geophysical anomalies match the outline of a felsic intrusive hosting secondary K-feldspar and biotite stockworks. The intrusion shows disseminated chalcopyrite and copper oxides at surface. The intrusion is highly anomalous and extends 1000 m x 200 m at surface, supporting an exploration target of one million tonnes of contained copper. It can be tested by a series of drill fences along the 1 km of strike. The target is ready to be drilled in 2024.”

Terms of the Transaction

The terms of the Option require that a work program is completed, consisting of:

- At least US$1 million of project work, including 3,000 m of drilling in Year One.

- At least US$4 million of project work, with no consecutive 12 month period seeing less than US$ 500,000 of project work, in Years Two-Four.

Subject to the requisite investment having been met, Norseman can exercise the option by making a US$2 million payment to the Vendors in Year Five. A further bullet payment to the Vendors is due at the point of a construction decision being made, comprising US$2 per tonne of contained copper within compliant NI 43-101 defined resources. In addition, the Vendors are granted a 3% NSR, of which 1.5% can be purchased by Norseman for US$7.5 M at any point prior to a construction decision being made.

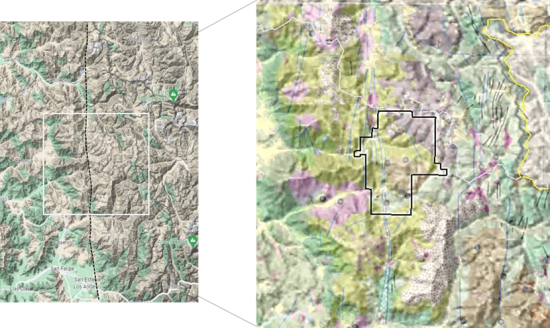

Location

The project comprises 18,000 Ha of concessions, at an average altitude of 2,200 m. Caballos is 210 km from Santiago, via the R5N Highway. The project will be supported from the nearby towns of Cabildo or Petorca towns via internal roads. Unpaved road access reaches within 9 km of the main target area.

Project History

In 1994 BRGM (French Geological Survey) performed a stream sediment survey over the Cordilleran belt between Regions IV and V, Chile. One of the main anomalies (Cu-Zn-Pb-Au) of the survey corresponds to what is now the southern part of Caballos, with up to 409 ppm Cu, 70 ppb Au, 305 ppm Zn and 145 ppm Pb.

In 1998 Blue Desert Mining, a junior company, claimed the property and carried out a geophysical survey in what is the northern part of Caballos. IP Gradient, Pole-Dipole and Mag surveys were executed in a limited sector around Cerro Las Mulas.

In 2004 the present owners staked the first 7,000 Ha in the southern part and, in the subsequent years expanded control to 18,000 Ha of exploration tenements. In 2006 the property was optioned to VALE who generated a geological map, collected approximately 200 rock and soil samples and performed an IP dipole-dipole over the same Cerro Las Mulas area. In 2008 Vale dropped the option.

In 2011 BHP worked in the Caballos South area. BHP carried out rock-chip sampling in the northern portion, and new stream sediment sampling in the southern part of the property, in the same area where BRGM found the strong multi-elements stream sediment anomaly. Soon after, a private investor independently carried out stream sediment sampling in the area which returned a robust stream sediment anomaly, with values up to 1420 ppm Cu, 164 ppm Mo and 0.1 g/t Au. The anomaly is related to an elongated hydrothermal breccia (1,300 m long), associated with the regionally important Pocuro Fault Zone (“PFZ”). The breccia contains patches of tourmaline and Cu-oxides spots and signs of argillic alteration. A halo of limonite and sericite surrounds the breccia.

Project Geology and Historic Results

Historic information shown below are taken from reports variously prepared by the Companies that previously worked the area and shared results with the Vendors. Norseman Silver has not carried out quantitative re-sampling of the area, nor completed check assays of the sample data.

The Caballos area straddles geology of the Miocene Farellones Formation and the Oligocene Abanico Formation. Age-dating at Caballos is not conclusive, with a K-Ar radiometric date of 25.5 Ma +/- 0.7 Ma. Caballos is located over an important regional fault system, the Pocuro Fault Zone. The PFZ is a clearly visible regional-scale morphological feature that has been mapped in a N-S trend for more than 200 km (see Fig.2). The PFZ is a high-angle reverse fault (with vergence to W) and was active at least until the Early Miocene. The fault zone has been described as a 'megafault' that stands out as one of the largest geological features in the region.

Figure 2. The Pocuro Fault Zone relative to the Caballos project location

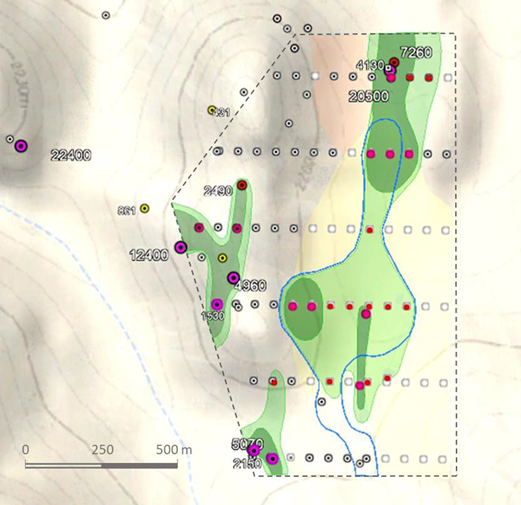

At Cerro Las Mulas, a soil and rock geochemistry indicates a copper anomaly, partially mirrored in molybdenum and gold chemistry along 1,200 m of strike. The anomaly is open in several directions (see Figure 3). The main anomaly coincides with the presence of a felsic intrusive with K-feldspar and biotite stockworks, with disseminated chalcopyrite and copper oxides at surface. The intrusion at Cerro Las Mulas is located in a wide and gently sloping valley and the intrusion itself is largely covered by a colluvium apron.

Figure 3. Caballos North, geochemical grid in Cerro Las Mulas

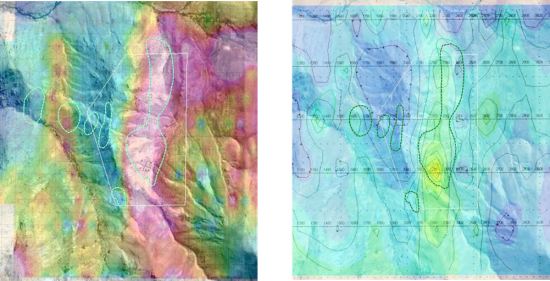

Also at Cerro Las Mulas, two different induced polarization (“IP”) surveys shows chargeability coincident with the geochemical copper anomalies. The first IP survey was a Gradient survey carried out by Quantec in 1998. The second IP survey was a dipole-dipole survey carried out by Zonge in 2006. Screen-grab images of the anomalies are shown in Figure 4, below.

Figure 4. IP Gradient Survey by Quantec showing apparent chargeability from pseudo-sections (left) and IP dipole-dipole Zonge 2006 D-D IP, 100m slice 2D inversion (right)

The Vendors note that the IP pole-dipole raw data from 1998 was reprocessed in 2023. The geophysicist that carried out the reprocessing work was the same geophysicist that carried out the original Quantec 1998 survey. He reported that “The chargeability anomalies are low in amplitude; however, they display excellent line-to-line correlation and form anomalies of potentially economic size.” The commentary continued by saying, “the chargeable source is attributed to sulphide mineralization” and “the chargeability source appears to continue to depth, possibly widening”.

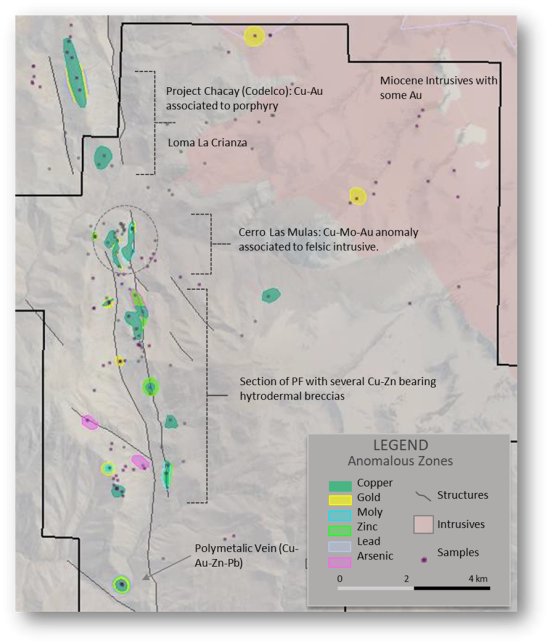

Outside of the immediate Cerro Las Mulas target area, anomalous and abundant copper is found in several zones located along over 10 km of the Pocuro Fault Zone which traverses the western portion of the property. The elevated geochemical values are mainly associated with stocks and hydrothermal breccias around the PFZ (see Figure 5, below). The central and southern part of the PFZ host several hydrothermal breccias with copper, zinc, and locally molybdenum. The average copper grade of all samples taken to date across the property is 850 ppm Cu.

Figure 5. Map of sample locations, main anomalies, and the Pocuro Fault Zone

Exploration Target and Next Steps

The exploration target at Cerro Las Mulas is a conceptual target based on the following metrics: length 1000 x width 200 x depth 400 x density 2.7 x grade 0.5 % Cu.

In the first half of 2024 Norseman will prepare the exploration team and the logistics to support a drill program. The Company has a conceptual plan to drill twelve holes averaging 250 m each for approximately 3,000 m in a number of fences along 1 km of strike length. Drilling is planned for the second half of the year.

Qualified Person

The technical information in this news release was reviewed by Gilberto Schubert, P. Geo., a qualified person as defined under National Instrument 43-101 (NI 43-101).

About Norseman Silver

Norseman’s shares are listed on the TSX Venture Exchange under the symbol NOC and on the OTCQB under the symbol NOCSF. Learn more about Norseman at www.norsemansilver.com.

This press release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended, or any state securities laws and may not be offered or sold within the United States or to or for the account or benefit of a U.S. person (as defined in Regulation S under the United States Securities Act) unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

On behalf of Norseman Silver Inc.

Sean Hurd

President and CEO

For further information, please contact:

Sean Hurd President and CEO

Info@norsemansilver.com

+1 604-505-4554

For more information on Norseman Silver, please visit the Company's website.

www.norsemansilver.com.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OF THIS RELEASE.