Caballos Copper

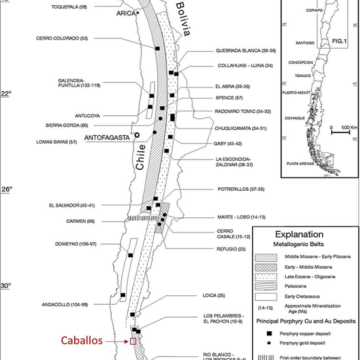

Location

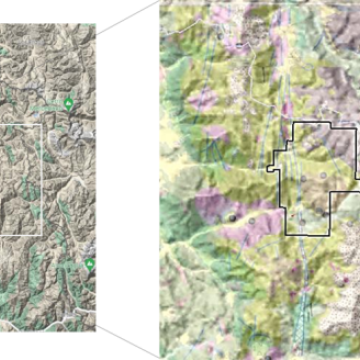

The project comprises 18,000 Ha of concessions, at an average altitude of 2,200 m. Caballos is 210 km from Santiago, via the R5N Highway. The project will be supported from the nearby towns of Cabildo or Petorca towns via internal roads. Unpaved road access reaches within 9 km of the main target area.

Project History

In 1994 BRGM (French Geological Survey) performed a stream sediment survey over the Cordilleran belt between Regions IV and V, Chile. One of the main anomalies (Cu-Zn-Pb-Au) of the survey corresponds to what is now the southern part of Caballos, with up to 409 ppm Cu, 70 ppb Au, 305 ppm Zn and 145 ppm Pb.

In 1998 Blue Desert Mining, a junior company, claimed the property and carried out a geophysical survey in what is the northern part of Caballos. IP Gradient, Pole-Dipole and Mag surveys were executed in a limited sector around Cerro Las Mulas.

In 2004 the present owners staked the first 7,000 Ha in the southern part and, in the subsequent years expanded control to 18,000 Ha of exploration tenements. In 2006 the property was optioned to VALE who generated a geological map, collected approximately 200 rock and soil samples and performed an IP dipole-dipole over the same Cerro Las Mulas area. In 2008 Vale dropped the option.

In 2011 BHP worked in the Caballos South area. BHP carried out rock-chip sampling in the northern portion, and new stream sediment sampling in the southern part of the property, in the same area where BRGM found the strong multi-elements stream sediment anomaly. Soon after, a private investor independently carried out stream sediment sampling in the area which returned a robust stream sediment anomaly, with values up to 1420 ppm Cu, 164 ppm Mo and 0.1 g/t Au. The anomaly is related to an elongated hydrothermal breccia (1,300 m long), associated with the regionally important Pocuro Fault Zone (“PFZ”). The breccia contains patches of tourmaline and Cu-oxides spots and signs of argillic alteration. A halo of limonite and sericite surrounds the breccia.

Project Geology and Historic Results

Historic information shown below are taken from reports variously prepared by the Companies that previously worked the area and shared results with the Vendors. Fitzroy Minerals has not carried out quantitative re-sampling of the area, nor completed check assays of the sample data.

The Caballos area straddles geology of the Miocene Farellones Formation and the Oligocene Abanico Formation. Age-dating at Caballos is not conclusive, with a K-Ar radiometric date of 25.5 Ma +/- 0.7 Ma. Caballos is located over an important regional fault system, the Pocuro Fault Zone. The PFZ is a clearly visible regional-scale morphological feature that has been mapped in a N-S trend for more than 200 km (see Fig.2). The PFZ is a high-angle reverse fault (with vergence to W) and was active at least until the Early Miocene. The fault zone has been described as a 'megafault' that stands out as one of the largest geological features in the region.

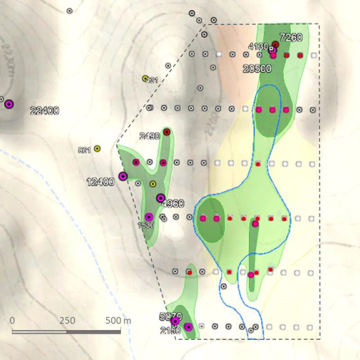

At Cerro Las Mulas, a soil and rock geochemistry indicates a copper anomaly, partially mirrored in molybdenum and gold chemistry along 1,200 m of strike. The anomaly is open in several directions (see Figure 3). The main anomaly coincides with the presence of a felsic intrusive with K-feldspar and biotite stockworks, with disseminated chalcopyrite and copper oxides at surface. The intrusion at Cerro Las Mulas is located in a wide and gently sloping valley and the intrusion itself is largely covered by a colluvium apron.

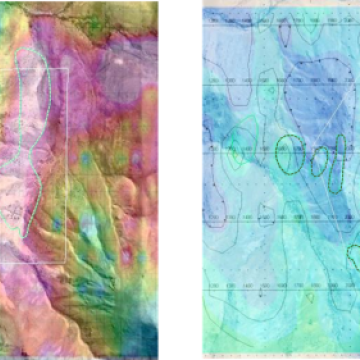

Also at Cerro Las Mulas, two different induced polarization (“IP”) surveys shows chargeability coincident with the geochemical copper anomalies. The first IP survey was a Gradient survey carried out by Quantec in 1998. The second IP survey was a dipole-dipole survey carried out by Zonge in 2006. Screen-grab images of the anomalies are shown in Figure 4, below.

Figure 4. IP Gradient Survey by Quantec showing apparent chargeability from pseudo-sections (left) and IP dipole-dipole Zonge 2006 D-D IP, 100m slice 2D inversion (right)

The Vendors note that the IP pole-dipole raw data from 1998 was reprocessed in 2023. The geophysicist that carried out the reprocessing work was the same geophysicist that carried out the original Quantec 1998 survey. He reported that “The chargeability anomalies are low in amplitude; however, they display excellent line-to-line correlation and form anomalies of potentially economic size.” The commentary continued by saying, “the chargeable source is attributed to sulphide mineralization” and “the chargeability source appears to continue to depth, possibly widening”.

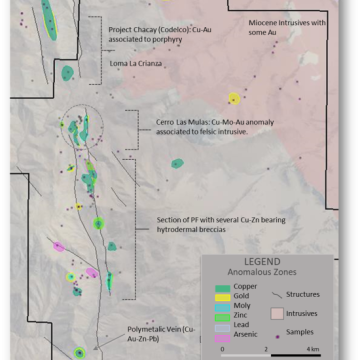

Outside of the immediate Cerro Las Mulas target area, anomalous and abundant copper is found in several zones located along over 10 km of the Pocuro Fault Zone which traverses the western portion of the property. The elevated geochemical values are mainly associated with stocks and hydrothermal breccias around the PFZ (see Figure 5, below). The central and southern part of the PFZ host several hydrothermal breccias with copper, zinc, and locally molybdenum. The average copper grade of all samples taken to date across the property is 850 ppm Cu.

Terms of the Transaction

The terms of the Option require that a work program is completed, consisting of:

- At least US$1 million of project work, including 3,000 m of drilling in Year One.

- At least US$4 million of project work, with no consecutive 12 month period seeing less than US$ 500,000 of project work, in Years Two-Four.

Subject to the requisite investment having been met, Fitzroy can exercise the option by making a US$2 million payment to the Vendors in Year Five. A further bullet payment to the Vendors is due at the point of a construction decision being made, comprising US$2 per tonne of contained copper within compliant NI 43-101 defined resources. In addition, the Vendors are granted a 3% NSR, of which 1.5% can be purchased by Fitzroy for US$7.5 M at any point prior to a construction decision being made.

Subscribe for Updates

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.